by Feliciano Financial Group | Asset Protection, Asset Protection, Business Owner Financial Planning, College Planning, Education, Estate Planning, Family, Family Financial Planning, Feliciano Financial Group, Financial Advisor, Financial Planner, Health Care Planning, Income Planning, Insurance, Insurance Planning, Investment Planning, Legacy Planning, Life Insurance, Misconceptions, Retirement Planning, Tax Deduction, Tax Planning, Wealth Management, Wealth Planning

Retirement is one of the biggest transitions in life, financially and emotionally. These 26 questions reflect what retirees and those approaching retirement most commonly ask when they want clarity, confidence, and coordination in their financial decisions. Our goal...

by Feliciano Financial Group | Asset Protection, Business Owner Financial Planning, Business Planning, Estate Planning, Family Financial Planning, Feliciano Financial Group, Financial Advisor, Financial Planner, Financial Planning, Future, Goals, Health Care Planning, High-Net Worth Financial Planning, Insurance, Insurance Planning, Insurance Specialist, Investment, Legacy Planning, Life Insurance, Small Business, Tax Planning, Taxes, Uncategorized, Wealth Management

What We Do for Business Owners, Medical Professionals, or Practice Owners and Why It Matters to Your Future You Built Your Business With Vision. Now Build a Future That Honors It. When you’re a medical practice or business owner, your financial life isn’t simple,...

by Feliciano Financial Group | Asset Protection, Asset Protection, Business Planning, College Planning, Estate Planning, Family, Family Financial Planning, Feliciano Financial Group, Financial Advisor, Financial Planner, Financial Planning, Health Care Planning, High-Net Worth Financial Planning, Income Planning, Insurance, Insurance Planning, Investment Planning, Legacy Planning, Life Insurance, Live Life On Purpose, Long-Term Care Planning, Retirement Planning, Tax Planning, Taxes, Wealth Management, Wealth Planning

Do you have a local East Texas financial planning team that truly understands what matters most to you? Are your family’s financial plans built around your life, or just your numbers? Does your Tyler, Texas financial advisor help you make decisions with...

by Feliciano Financial Group | Family, Feliciano Financial Group, Future, Health Care Planning, Insurance Planning, Life Insurance, Long-Term Care Planning, Wealth Management, Wealth Planning

A Conversation That Can Protect Everyone You Love Introduction It’s a difficult shift: the people who raised you now need your help planning for the future. Whether they’re aging, retiring, or simply avoiding financial conversations, many parents lack a comprehensive...

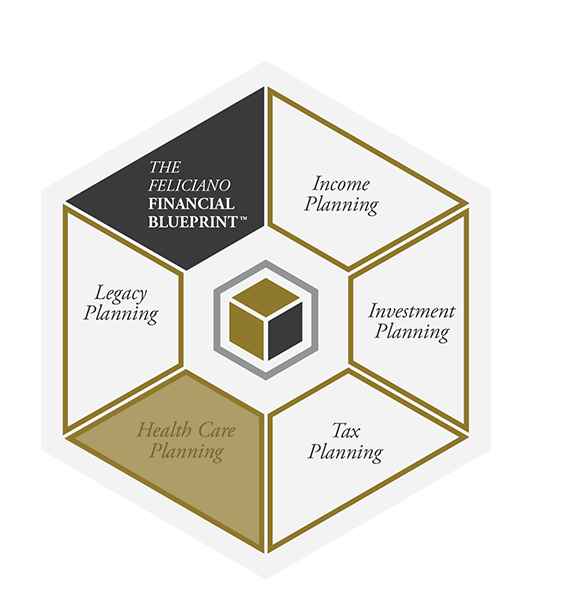

by Feliciano Financial Group | Asset Protection, College Planning, Estate Planning, Feliciano Financial Group, Financial Advisor, Financial Planner, Financial Planning, Health Care Planning, Income Planning, Insurance Planning, Insurance Specialist, Investing, Investment, Investment Planning, Legacy Planning, Life Insurance, Long-Term Care Planning, Retirement Planning, Tax Planning, Wealth Management, Wealth Planning

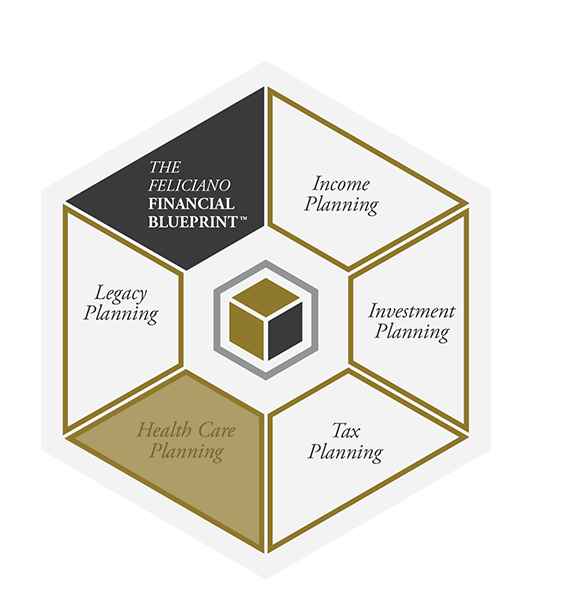

In a world where financial advice often comes in fragmented pieces, investment tips here, tax guidance there, it’s easy to miss the bigger picture. But your financial life isn’t made up of silos. Every decision affects the others, and without a clear, connected plan,...

by Feliciano Financial Group | Advice, Asset Protection, Estate Planning, Feliciano Financial Group, Financial Advisor, Financial Planning, Financial Tips, Health Care Planning, Insurance, Insurance Planning, Insurance Specialist, Investing, Investment, Legacy Planning, Life Insurance, Retirement Planning, tax planner, Tax Planning, Wealth Management

It’s not just you. Most people feel overwhelmed when it comes to financial planning. Whether it’s balancing investments, understanding insurance policies, or figuring out when to retire, trying to do it all alone can feel like assembling a 10,000-piece puzzle without...