by Feliciano Financial Group | Family, Family Financial Planning, Feliciano Financial Group, Financial Advisor, Financial Planner, Financial Planning, Future, Holidays

Holistic Family Financial Planning: Peace, Purpose, and Protection During the Celebration Season The year-end and celebration season are times of reflection, gathering, and connection. It is the perfect opportunity to commit to holistic family financial planning, a...

by Feliciano Financial Group | Advice, Budgeting, Family, Feliciano Financial Group, Financial Advisor, Financial Planner, Financial Planning, Financial Tips

The “sandwich generation”, those simultaneously caring for aging parents and supporting children, faces a unique and challenging financial tightrope. You’re juggling tuition, caregiving, retirement savings, and maybe even downsizing your home or upgrading your...

by Feliciano Financial Group | Advice, Business Planning, College Planning, Estate Planning, Family, Feliciano Financial Group, Financial Advisor, Financial Planning, Future, Goals, Legacy Planning, Retirement Planning, Tax Planning, Uncategorized, Wealth Planning

Life is full of transitions; some are expected, and some are not. Whether you’re preparing for retirement, changing jobs, selling a business, experiencing a loss, or navigating a divorce, major life changes often bring with them a cascade of financial decisions....

by Feliciano Financial Group | Advice, Communication, Education, Family, Feliciano Financial Group, Financial, Financial Planning, Financial Tips, Future, Goals, multigenerational wealth, Young Families

Money can be one of the most difficult and most important topics to talk about with your children. Whether your kids are in kindergarten or college, the way you introduce financial conversations can shape their future confidence, habits, and values around money. At...

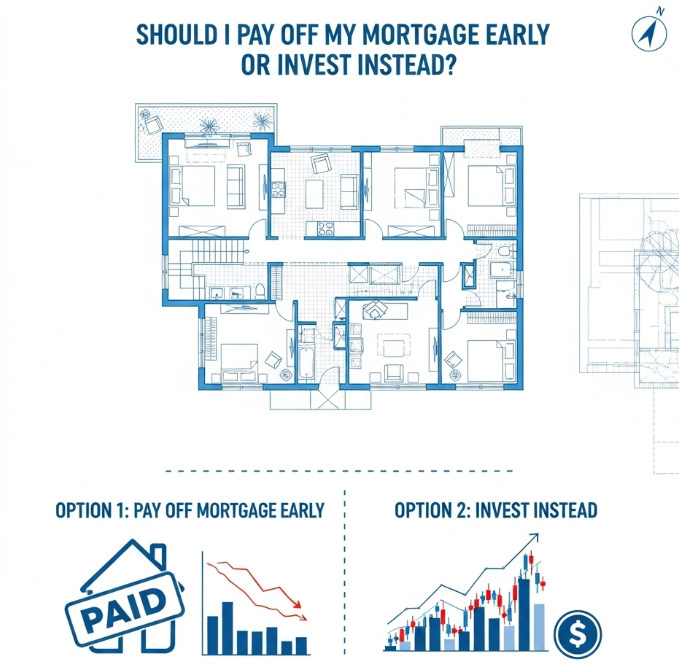

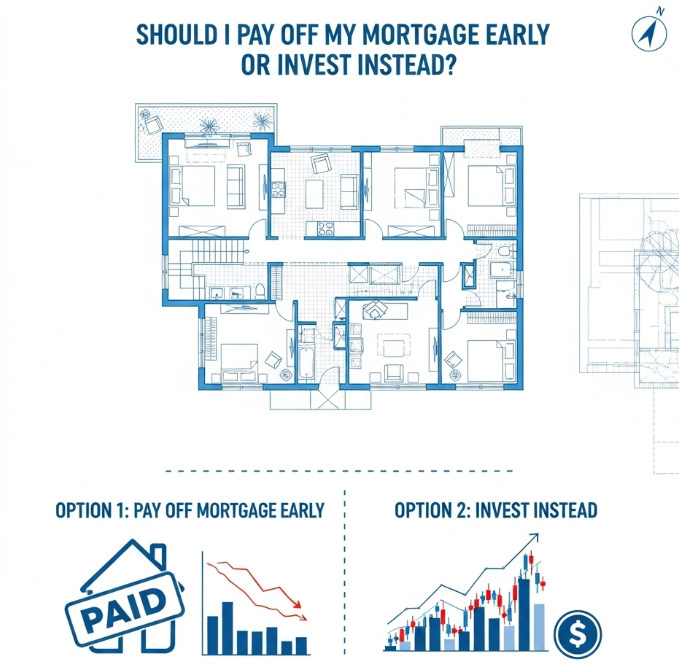

by Feliciano Financial Group | Asset Protection, Estate Planning, Family, Feliciano Financial Group, Financial Advisor, Financial Planner, Financial Planning, Financial Tips, Investing, Investment Planning, Wealth Planning

One of the most common and most debated, financial questions we hear is this: “Should I pay off my mortgage early, or should I invest the extra cash instead?” At first glance, it seems like a simple math problem. But as with most financial decisions, the answer...

by Feliciano Financial Group | Asset Protection, Family, Feliciano Financial Group, Financial Advisor, Financial Planner, Financial Planning, Financial Tips, Future, Goals, Live Life On Purpose, Retirement Planning, Wealth Management, Wealth Planning

For many women, financial planning isn’t just about numbers it’s about feeling confident, secure, and in control of your life and future. Yet too often, women are left out of the financial conversation, or they find themselves suddenly responsible for complex...