by Feliciano Financial Group | Asset Protection, Asset Protection, Business Planning, Capital Gains, College Planning, Estate Planning, Feliciano Financial Group, Financial Advisor, Financial Planner, High-Net Worth Financial Planning, Income Planning, Insurance Planning, Investment Planning, Legacy Planning, Long-Term Care Planning, Portfolio, Retirement Planning, Tax Planning, Wealth Management, Wealth Planning

At a certain level of success, your financial life stops being about accumulation of wealth, it becomes about coordination, clarity, and control. You have built a positive financial future, and now the question shifts from “How much do I have?” to “How do I protect...

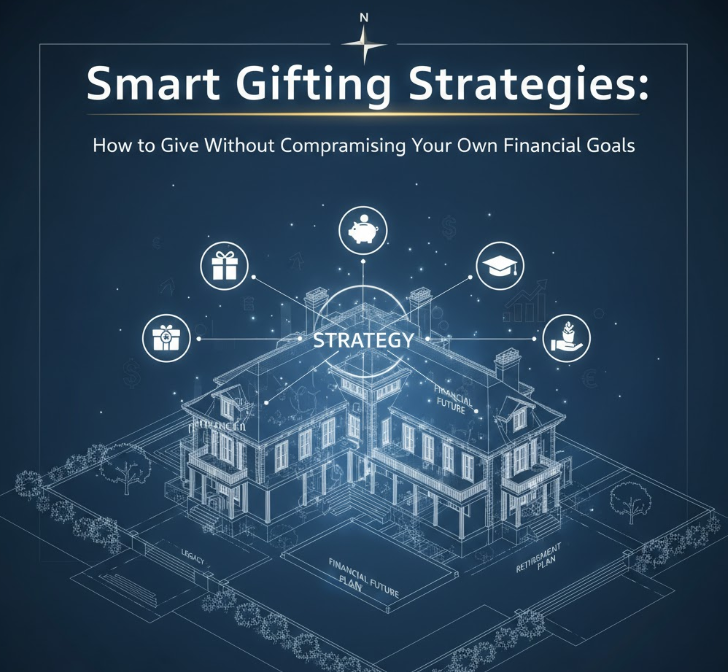

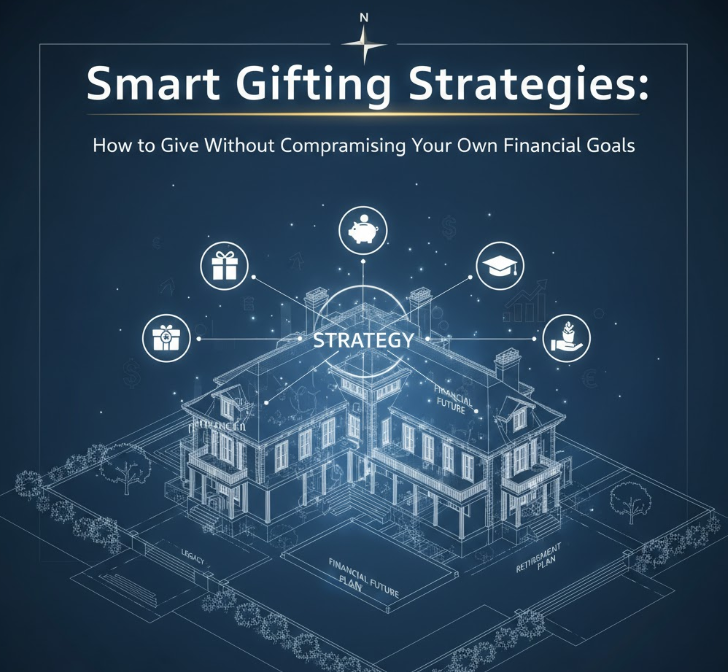

by Feliciano Financial Group | Advice, Asset Protection, Capital Gains, charity, College Planning, Family, Financial Tips, Holidays, Income Planning, Investment Planning, Wealth Management, Wealth Planning

Giving can be one of the most rewarding aspects of financial success, whether it’s helping a child buy their first home, supporting a charitable cause, or simply surprising someone you love. But giving without a plan can lead to unintended consequences, including tax...

by Feliciano Financial Group | Asset Protection, Asset Protection, Business Planning, College Planning, Feliciano Financial Group, Financial Advisor, Financial Planner, Financial Planning, Financial Tips, Income Planning, Investment Planning, Tax Planning, Wealth Management, Wealth Planning

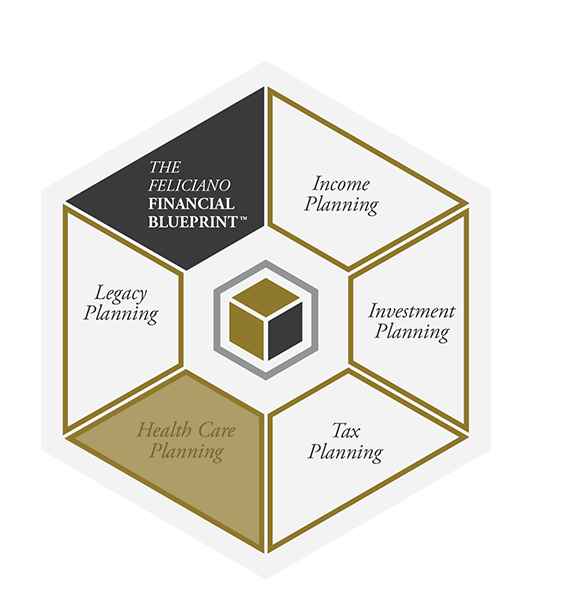

In a world where financial decisions are more interconnected than ever, the traditional approach of piecemealing advice from multiple professionals, an investment advisor here, a tax preparer there, and maybe an insurance agent on the side, that no longer works. The...

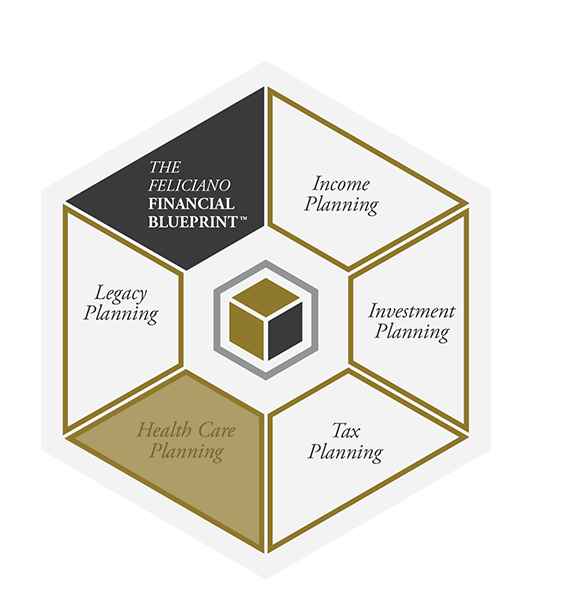

by Feliciano Financial Group | Asset Protection, College Planning, Estate Planning, Feliciano Financial Group, Financial Advisor, Financial Planner, Financial Planning, Health Care Planning, Income Planning, Insurance Planning, Insurance Specialist, Investing, Investment, Investment Planning, Legacy Planning, Life Insurance, Long-Term Care Planning, Retirement Planning, Tax Planning, Wealth Management, Wealth Planning

In a world where financial advice often comes in fragmented pieces, investment tips here, tax guidance there, it’s easy to miss the bigger picture. But your financial life isn’t made up of silos. Every decision affects the others, and without a clear, connected plan,...

by Feliciano Financial Group | Advice, Asset Protection, Asset Protection, Budgeting, Estate Planning, Family, Financial Advisor, Financial Planning, Financial Tips, Income Planning, Inflation, Investing, multigenerational wealth, Wealth Management, Wealth Planning

Stay Ahead of Rising Costs with Smart, Sustainable Strategies Introduction Inflation isn’t just a headline—it’s a household reality. From grocery prices to housing costs, inflation affects your day-to-day life and your long-term financial goals. In 2025, while...

by Feliciano Financial Group | Advice, Budgeting, Business Planning, Challenges, Communication, Education, Estate Planning, Family, Feliciano Financial Group, Finance, Financial, Financial Advisor, Financial Planner, Financial Planning, Financial Tips, Future, Goals, Income Planning, Investing, Investment Planning, Legacy Planning, Live Life On Purpose, Long-Term Care Planning, multigenerational wealth, Personal Finances, Planning, Retirement, Retirement Planning, tax planner, Tax Planning, Taxes, Wealth Planning

Retirement planning is a complex process that requires careful consideration. While youcan manage it on your own, consulting with financial professionals with integrated financialservices like Feliciano Financial Group can offer several significant benefits:1....