Providing benefits for your employees.

Group Insurance

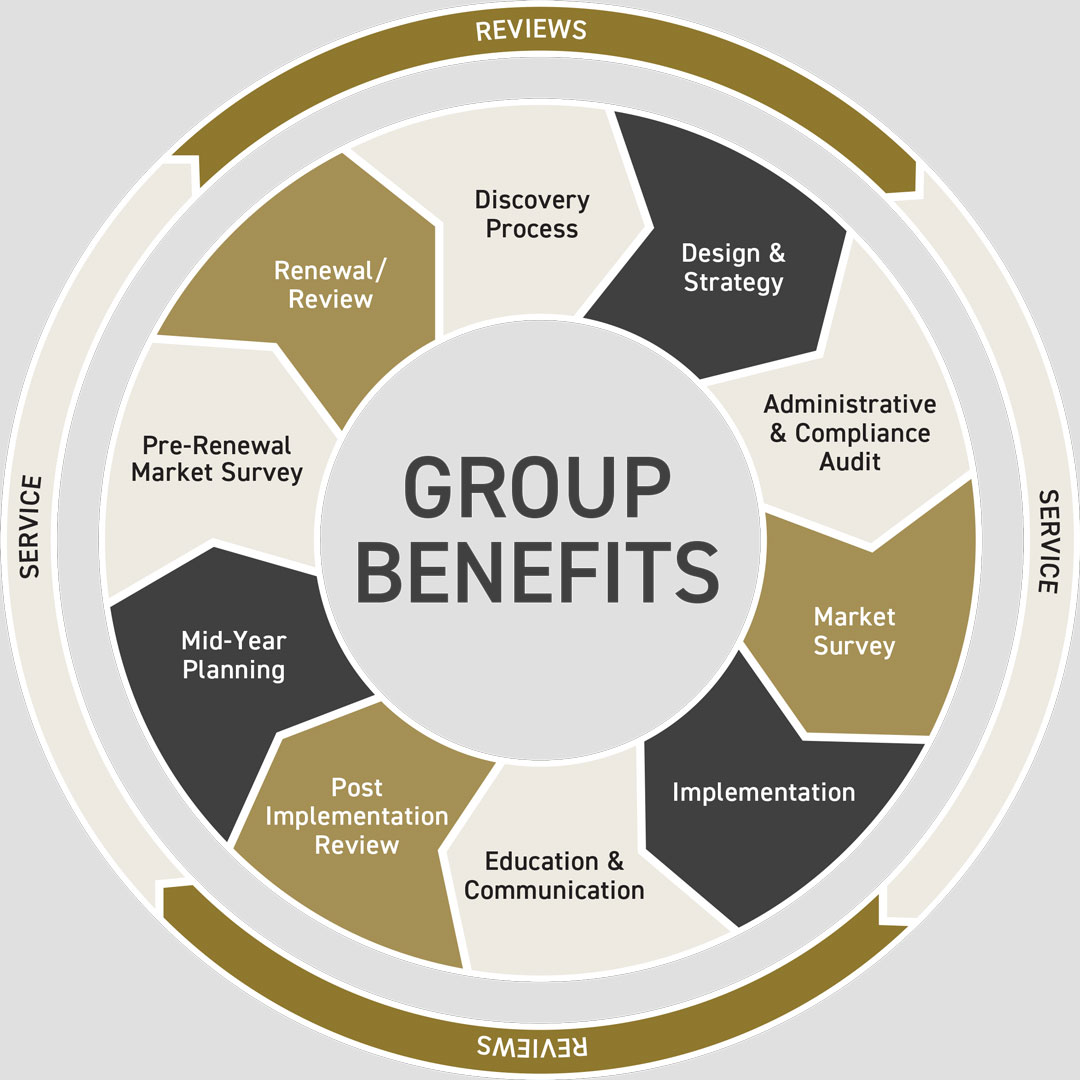

Employee Benefits

Medical expenses can quickly add up, and most people are unable to pay for health care out of pocket. In order to defray these costs, people purchase health insurance.

Schedule a Consultation with us to review your options.

With Feliciano Benefits you get:

- A homegrown broker who takes the time to understand your industry and tailors your benefits platform to your company’s needs.

- A committed team to help you uncover the best options for you and your employee’s needs.

- A Brokerage that can service all of your financial necessities under one roof.

- An ally to help handle HR, Technology, COBRA, & Compliance Administration.

- A well-rounded broker and partner to help you with company growth.

- A true local family firm.

- Executive benefits.

Group Insurance for Employees

There are two primary venues for health insurance: individual policies and group insurance for employees, (Group Benefits Services). Although individual policies are gaining in popularity, group health is by far the most popular and common way for individuals to obtain insurance.

How Does Group Benefits Health Insurance Work?

A group health policy for employees is purchased in bulk from an insurance provider. The purchaser is usually an employer, and the group policy covers all employees at that company. Individual employees will pay premiums as a way to reimburse the employer for the cost of coverage; these premiums are usually much cheaper than they would be if the employee bought an individual policy for himself.

Current legislation requires all employers to provide some form of health insurance to employees. This means that many employers are searching for the best deal on policies, creating a very competitive market. Many employers purchase two or three types of policies that can be chosen by employees through a cafeteria plan, while others prefer to purchase only one set of coverages that will apply to all employees who choose to participate.

What Are the Benefits of Group Health Coverage?

Buying insurance this way allows for risk to be spread evenly over a large group of people; even if some employees must use their insurance in one year, many more will pay premiums that year without requiring any insurance services. Spreading the risk allows the insurance company to keep premiums low. It also allows individuals to obtain insurance even if they would not qualify for an individual policy.

For example, some individual policies will require the insured to pass a physical exam before coverage can be applied. In other cases, people with pre-existing medical conditions cannot get an individual insurance policy, or can only get one for a heavy cost. Group health plans do not have these restrictions, making them an affordable health care option for people who are employed.

Not everyone will choose to enroll in their employer’s group health plan. Some people prefer the flexibility of another insurer, and some individuals would rather save money by avoiding insurance altogether and taking the risk of being uninsured. Most employees, however, will opt for group insurance, so it’s important for any employer to provide affordable options to the employees.

Where to Purchase Group Health Coverage?

If you are a business owner, you will want to purchase an affordable health care plan for your employees. We know the best way to find the best company to suit your needs is by comparison shopping. We can generally filter these results by price, coverage or other criteria that will help narrow down the search to plans that will suit your needs.

Call us today! 903-533-8585

Most Plans fall into one of the below categories:

- PPO

- HMO

- HDHP

- Reference Based

- EPO

- Fully Insured Indemnity Plans

- Dental & Vision

- Group Life & AD&D

- Supplemental & Voluntary

- Accident

- Critical Illness

- Cancer

- Disability

- Hospital Indemnities

- Travel Medical Insurance

Employer Benefits Platforms

These platforms are designed to help with enrollments in person or online, while also “helping” maintaining your day to day such as payroll deduction reports.

As fun as HR administration is, these are a wonderful addition to your benefits program. Adding and removing employees, providing portals for your employees to access their own benefits

information.

Have a question?

Let’s start a conversation about your business.