Providing benefits for your employees.

Group Insurance

Organize & Simplify:

Group Benefits That Actually Work

Schedule a Consultation with us to review your options.

The Feliciano Benefits Difference

When you work with us, you get:

✔️ A homegrown broker who takes time to understand your industry

✔️ A local team that helps uncover the best platform for your needs

✔️ HR, technology, COBRA, and compliance support—under one roof

✔️ A benefits strategy aligned with your retirement and tax planning

✔️ A streamlined experience for onboarding, renewals, and year-round service

✔️ Access to Executive Benefits and Supplemental Coverages

Health insurance is one of the most important benefits you can offer, yet for many employers, it’s also one of the most confusing, expensive, and time-consuming parts of running a company. That’s the Trust Gap—when you’re expected to provide a great benefits experience, but you don’t feel like you have the full picture.

At Feliciano Benefits, we help you close that gap.

We’re a locally rooted, family-run brokerage that understands your industry, your team, and your goals. We help you offer meaningful coverage, manage compliance, and streamline the entire experience—without wasting your time or stretching your resources.

Why Group Benefits Matter

– Risk Pooling = Lower Costs: Group health plans allow for more favorable pricing, especially when compared to individual policies.

– Access for Employees: Group coverage often includes protections that individuals can’t get on their own—such as coverage with pre-existing conditions or without a physical exam.

– Stronger Retention & Culture: Benefits communicate more than coverage—they reflect how you care for your people.

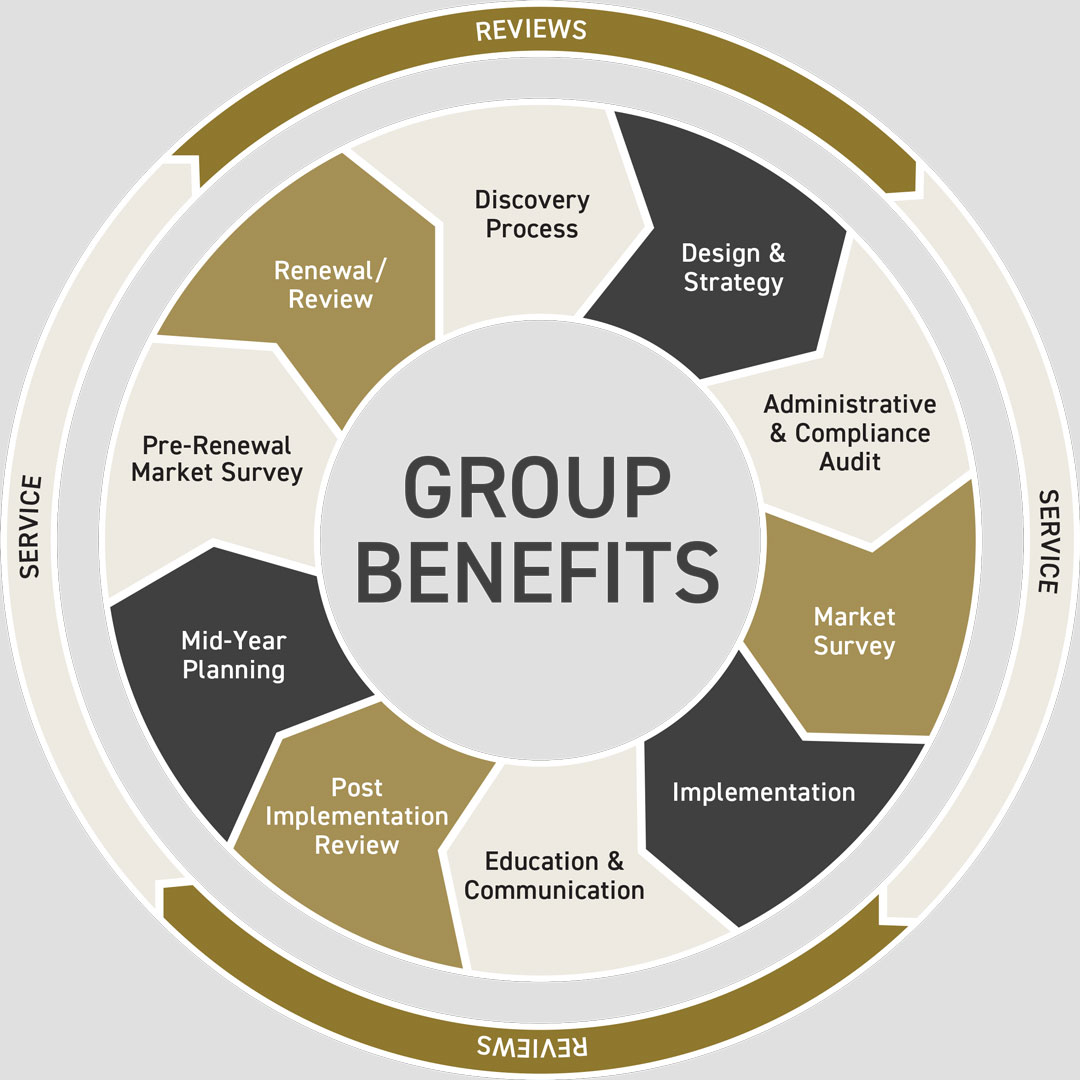

How It Works

Group health insurance is typically purchased by an employer and offered to eligible employees, often with several plan options available (via a cafeteria plan or bundled offering). Employees then pay premiums—usually at a lower rate than if they were purchasing on their own.

Let’s Make It Easy

You don’t have to chase agents, compare spreadsheets, or guess what’s right for your team. We’ll help you:

Organize your options. Simplify your process. Clarify your strategy.

📞 Call us today at 903-533-8585

📅 Or Schedule a Consultation to start the conversation.

Most employers today

offer plans in one or

more of these formats:

– PPO • HMO • HDHP

– Reference-Based Pricing Plans

– EPO • Fully Insured Indemnity Plans

– Group Dental & Vision

– Group Life & AD&D

– Supplemental (accident, critical illness, cancer, disability, hospital)

– Travel Medical Insurance

Employer Benefits Platforms

We support platforms that simplify everything from online enrollment to payroll deduction reports. These tools make it easier to:

– Add and remove employees

– Maintain compliance

– Give employees access to their own benefits info

– Reduce the burden of day-to-day HR tasks

Have a question?

Let’s start a conversation about your business.