Feliciano Financial Blueprint™ Consultation

Schedule your FREE consultation with a Certified Financial Planner™ today!

Use this form or call us directly at:

(903) 533-8585

A new year means new tax changes. While Congress didn’t pass any major tax reform last year, there are still updated tax provisions that could affect how much money you keep and how much goes to Uncle Sam.

Here, I’ve included some of the most significant of these changes for investors and retirees. My suggestion: Look over the material below and circle any information you have questions about. Then, feel free to share this letter with your tax professional! He or she should be able to answer any questions you have.

One last thing. As you know, tax season is now upon us. To help reduce the stress of tax season, your accountant or tax preparer may contact us directly – with your permission – for any needed investment information. We are always happy to coordinate with any other financial professional you work with to minimize your workload.

As always, if there’s anything my team or I can do to be of assistance, please let us know. Have a great month!

Tax-Related Updates for Your 2021 Filing

Changes to Filing Deadline

One important tax-related change to note before we get into the nitty-gritty: This year’s filing date is April 18 for most people, instead of the usual April 15. (Residents of Maine and Massachusetts, meanwhile, have until April 19. Lucky!)

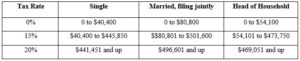

Changes to Federal Tax Brackets1

As it often does, the IRS has adjusted the 2021 tax brackets based on inflation. (Note, however, that by inflation I do not mean the current skyrocketing inflation we’re experiencing at the supermarket or when buying a used car. These brackets are based on the more standard inflation the IRS expected all the way back in 2020.) They are as follows:

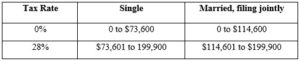

Changes to Capital Gains1

The income threshold for long-term capital gains rates has also gone up.

Changes to Deductions2

As you know, when you file your taxes, you can either claim a standard deduction or dive into the details and itemize your deductions. (Since the passing of the Tax Cuts and Jobs Act back in 2017, most people choose the former.) Per the IRS, the standard deduction is “a specific dollar amount that reduces the amount of income on which you’ve been taxed.”3

The IRS has increased the standard deduction for your 2021 taxes. For singles, the standard deduction is now $12,550, up from $12,400. For married couples filing jointly, it is $25,100 up from $24,800. For heads of households, the standard deduction is $18,800, up from $18,650.2

Remember, you can’t take the standard deduction if you also itemize deductions. And for married couples filing separately, both spouses must take the same type of deduction. So, if one spouse chooses to itemize, the other spouse must as well.

There’s one slight exception to this, however. For the 2021 tax year, you can claim a separate charitable giving deduction on top of the standard deduction. This deduction is $300 per person, so a married couple filing jointly could deduct up to $600 for charitable contributions.4

(Note that if you choose to itemize your deductions, you can deduct your charitable contributions up to 100% of your adjusted gross income.)

Changes to Alternative Minimum Tax (AMT) Exemption Levels1

Due to the Tax Cuts and Jobs Act, the number of Americans who owe the AMT has been drastically reduced. But in case you fall under this category, the exemption levels for 2021 are as follows:

These exemption levels phase out between $523,600 and $818,000 for single individuals, and $1,047,200 and $1,505,600 for married couples filing jointly.

Child Tax Credit

Due to the American Rescue Plan, part of the government’s pandemic relief, many parents received advance payments for the expanded Child Tax Credit in 2021. The bill provided for half of the credit to be distributed in monthly payments between July and December. The other half comes this year as part of your tax refund.

If this applies to you, you can claim the remaining amount by following the instructions in Letter 6419, which the IRS sent out to taxpayers in December and January. If you did not get this letter, or misplaced it, you can find it online at www.irs.gov/individuals/understanding-your-letter-6419.

I hope you found this information helpful. Obviously, it’s not a completely exhaustive list of every tax change for 2022. But it is an overview of some of the most important ones. If you have any questions or concerns, please let me know. My door is always open!

Sources

1 “Revenue Procedure 2020-45,” Internal Revenue Service, https://www.irs.gov/pub/irs-drop/rp-20-45.pdf

2 “IRS provides tax inflation adjustments for tax year 2021,” Internal Revenue Service, https://www.irs.gov/newsroom/irs-provides-tax-inflation-adjustments-for-tax-year-2021

3 “Standard Deduction,” Internal Revenue Service, https://www.irs.gov/taxtopics/tc551

4 “Special rule helps most people get a deduction of up to $300 per individual, $600 for couples for gifts to charity,” Internal Revenue Service, https://www.irs.gov/newsroom/irs-joins-leading-nonprofit-groups-to-highlight-special-charitable-tax-benefit-available-through-dec-31